Not Everybody’s Accounting Online: Outsourced Bookkeeping and Accounting for “Offline” Clients

With all the focus on online technology, solutions that help you work smarter and not harder, and having mobile access to information at any time and from anywhere, you’d think that the entire world had adopted an entirely mobile and high-tech approach to life and business. The popularity of software-as-a-service models and apps for just about everything are certainly a testament to the movement toward a more connected and mobile lifestyle and business environment. However, not every business has adopted a comprehensive paperless, mobile-accessed, virtual working world – not by a long shot. In fact, more folks than you may realize are still using actual paper, writing things by hand (things like checks and invoices), filing piles of paperwork in stand-up filing cabinets, and generally doing things the long, slow, painful way and then recording it on PC-based spreadsheets. You know – the way we did things before the Internet showed up.

While paperless offices and technology-enabled approaches to collaborative business are gaining popularity and adopting users every day, there is a community of business users out there who are not as laser-focused on the high-tech approach to online accounting and working closer with their outsourced accountant or bookkeeper. These business people are just getting the job done, and have found ways to handle their information and processes that work for them. It is this business user that accounting professionals should not forget as they seek to adopt new and innovative cloud approaches to service delivery, and for a couple of reasons. First, this type of client is likely to be in need of process support and additional service as the business grows, and the accounting professional is in a great position to help with those needs. Second, this type of client exists in great number.

Consider the following scenario; a discussion I discovered when perusing a small business forum recently. The interesting thing is that this is a discussion I see pretty frequently with small business owners and entrepreneurs – the discussion about the value of actual accounting or bookkeeping solutions versus a simple spreadsheet approach to record keeping.

I am the owner of a brand new small business. It has only been up and running for a short time. My accountant is pressuring me to use the online version of QuickBooks, but I am doubtful as to whether this is the right software for me.

I know that QuickBooks has a lot of different features, but I really only need it to track spending and customer payments, and since it’s still early on, I don’t have a lot of either. I would only need the very basics, and would probably only check it every two weeks at most. The fees they want for the software would add up pretty quickly for something I’m not really going to use much. My business is very small (just me) and service-based (tour guide), without much potential for repeat customers. I don’t need the payroll, invoicing, or other advanced features.

I honestly think that the easiest thing for me would be some sort of spreadsheet or really basic software that I could put directly on my computer instead of accessing online.

The truth of the matter is that spreadsheets often provide the common ground between small business owners and their accountants. For a business owner, spreadsheets offer a simple and intuitive way to organize and record information because the column layout makes it easy to understand where to enter which data. For the accountant, a spreadsheet can fairly quickly be sorted, filtered and prepared as accounting or tax return data. While working with clients in a fully online, collaborative model may be the “best case scenario” in terms of delivering high levels of service in the most efficient manner, understanding how best to work with those clients in other scenarios is also necessary. Getting the spreadsheet from this type of client is generally not terribly difficult – they are often more than willing to email it. As long as the professional has a good document management solution to capture and manage these files, and introduce them into the firm workflow, then working with this type of offline client doesn’t have to be a huge impact to internal firm efficiency.

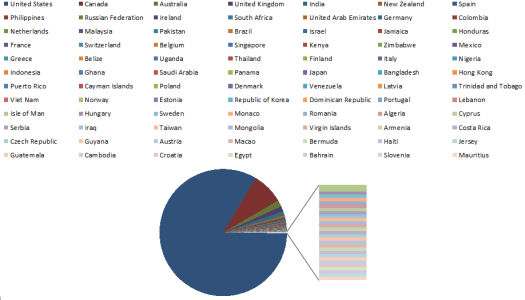

For accounting and bookkeeping professionals working with small business owners around the country, this type of client likely fits into the “normal” category more than those with a strong motivation to use cloud computing and having a great desire to use the Internet and connected services for everything they can (eventually the “new”normal?). I believe the reality is that only a small fraction of smaller companies – solo, soho, and small/medium business – are actively managing the majority of their business process and information online. In fact, Intuit (makers of QuickBooks) and other entry-level accounting and bookkeeping solution providers continue to heavily target small business users who are still tracking their finances using spreadsheets and other methods. This simplified and after-the-fact approach to spreadsheet record keeping is being further facilitated by the banks and credit card companies providing customers with a greater ability to classify and categorize transaction information, and then quickly download it into said spreadsheet.

Yes, the dichotomy is clear: many small business owners resist (or are, at least, unimpressed with) cloud accounting approaches, yet these very same individuals are likely utilizing cloud services from banks and other financial institutions to support their spreadsheet and checkbook record keeping, as well as accessing email and other services via the web for various reasons. It makes some sense, though, when you look at it from the business owner perspective. Their way sounds easier, is less overwhelming, and meets the need – for now.

J

Learn more about Working Online With Clients: How to leverage the internet and cloud computing to work closer with your clients

Read more about Online Accountants and Their Clients: Working Smarter, or just Closer?

Read more about Data Warriors: Accountants in the Cloud

Read more about using the cloud to extend “connectedness” beyond traditional boundaries