Every year, roughly 4.5 million US small businesses are started. The fuel which drives the American economy, small businesses account for more than 99% of all businesses in the US. And job creation happens in small business, which means growth also happens here. Growth happens at every stage of a business if the business is moving forward. From just starting out to achieving large enterprise status, the lifecycle of a business carries with it a multitude of learning moments.

As businesses implement solutions to manage accounting and operational needs, there is often less consideration for the agility of the solution to meet changing and expanding business needs than there is for affordability and the immediacy of the implementation. Small business owners frequently adopt solutions because they fit the needs now, not understanding what may happen when the business outgrows the solution. Sometimes a product meets the functionality requirements quite nicely yet can’t handle the increasing volume. These are among the issues facing growing businesses and forcing stakeholders to make more buying decisions regarding the software supporting the operation.

Each stage of a business where functional or process requirements change drives to another software buying decision. This buying decision is most often met with angst, as considerations include not only cost, but data conversion vs re-loading, new process or system design and setup, user training, proofing the system (running parallel?) and a host of other issues, not the least of which is the business benefit to be derived.

If information is power, too many businesses are losing that power when they migrate from one software product to another.

Businesses often lose valuable historical information by leaving transactional and other detail data behind when they change from one business software system to another. This should be an area of focus and key discussion point when any change to systems is considered. After all, the insight and business intelligence gathered over the years was likely instrumental in helping the small business grow to become a successful big business and will continue to be important for years to come.

Maximizing a return on investment is crucial with any business expenditure, whether it is in people, processes or systems.

The selection of software to support the operation plays a most important role in finding that value return, as the software is what empowers the people, guides the processes and drives the systems’ foundation. Knowing the crucial positioning of the software selection in supporting business growth and recognizing that future changes may risk loss of valuable business intelligence, the importance of the initial selection becomes that much greater.

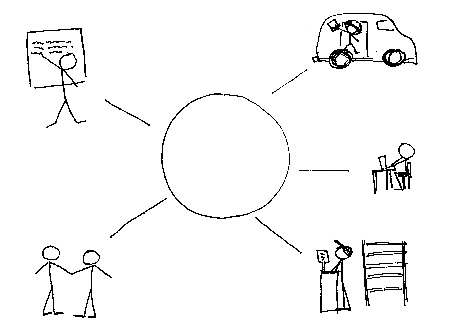

Mendelson Consulting will help you review your business and processes, building an understanding of what functionality needs to be supported and how the business intends to operate. For businesses looking to take the next step, we help identify where automation can improve efficiency and productivity. With that understanding, we help business owners and stakeholders navigate through the overwhelming landscape of solutions and approaches to find the right one for your business.

At every step and stage of business growth, Mendelson Consulting looks ahead to what’s next, helping our clients plan for the future.

While we don’t have a crystal ball, our experience coupled with industry and product knowledge allows us to make recommendations which minimize loss of valuable business intelligence while maximizing the ROI of the software which it informs.

Make Sense?

Make Sense?

J